Introduction

The real estate intelligence industry is undergoing a massive transformation. According to Leni, a market research and analytics platform, the global real estate software and analytics market is expected to exceed USD 25.39 billion by 2030, driven by the rising demand for real-time property valuations, predictive analytics, and smarter investment decision-making tools.

From institutional investors to retail property buyers, everyone is looking for data-driven confidence before making financial commitments.

Yet, intelligence is only as strong as the data infrastructure behind it. Algorithms and models have become sophisticated, but without real-time, reliable, and scalable data pipelines, even the most advanced platforms risk producing outdated or incomplete insights.

At RDS Data, we work as long-term data partners for real estate intelligence providers, building the pipelines that power valuation models, market benchmarking dashboards, risk modules, and predictive forecasts.

Why Data is the Lifeblood of Real Estate Intelligence Providers

The modern real estate landscape is dynamic, prices shift weekly, permits are granted daily, and new projects change market dynamics overnight. Intelligence providers must answer critical questions such as:

- What is the current fair market value of this property?

- Which neighborhoods are heating up or cooling down?

- How will new residential or commercial projects impact pricing and demand?

- Are there any regulatory or ownership risks tied to a property?

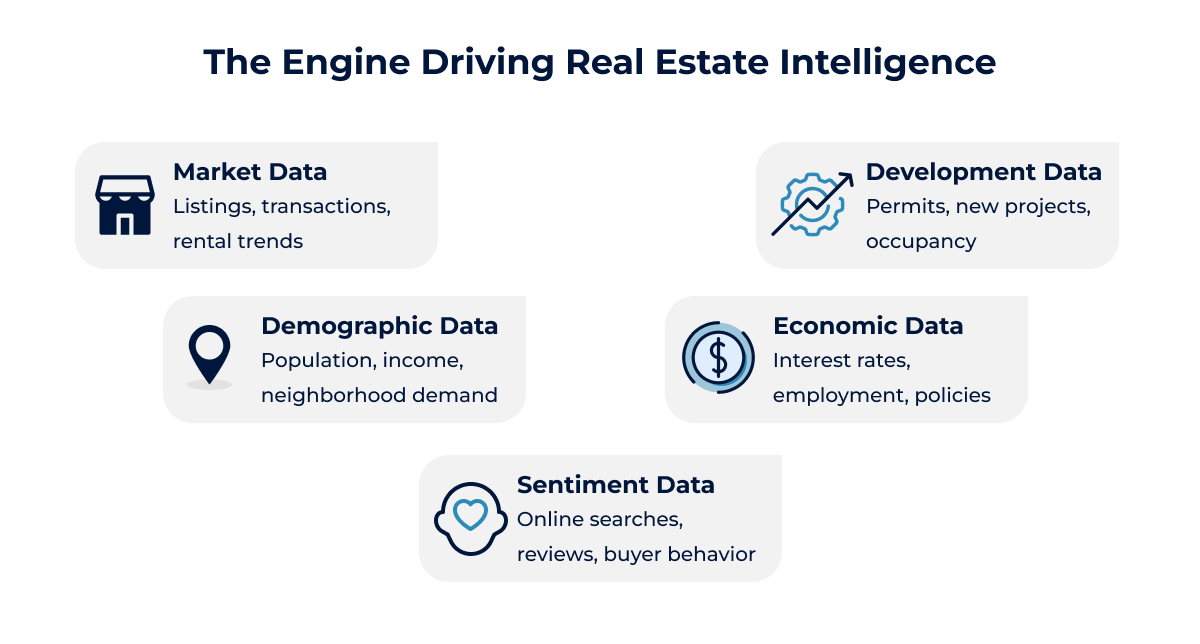

Delivering these insights requires millions of continuously updated data points from:

- Listing portals (Zillow, Realtor.com, Rightmove, MagicBricks, etc.)

- Competitor project sites and developer portals

- Social media chatter, online reviews, buyer forums

- Economic indicators and policy updates

Without a robust data pipeline, real estate platforms risk delivering outdated or inaccurate insights. For instance, a report by Mind Studios highlights that traditional analysis methods relying on historical data and cap rates are increasingly inadequate in today’s volatile market. Their findings show that predictive analytics can improve investment accuracy by 15–25% compared to conventional methods, enabling firms to make faster and more confident decisions. This underscores why data is not just a support function but the core engine of real estate intelligence.

Web Data Extraction: The Engine for Smarter Real Estate Intelligence

Web data extraction enables intelligence providers to automate the collection, structuring, and enrichment of property-related data at scale. This capability transforms business models in three critical ways:

i. Deeper Insights – Tapping into sources beyond partner data provides a more complete picture of market conditions.

ii. Always-On Intelligence – Scraping enables near real-time updates so models reflect true market dynamics.

iii. Scalable Infrastructure – No bottlenecks when processing hundreds of thousands of listings or transactions daily.

iv. Better Client Outcomes – Investors and brokers receive sharper, timelier insights, strengthening trust and retention.

In short, web scraping is not just about adding data, it is about enhancing competitive differentiation and opening new revenue streams for intelligence providers.

What Data Matters Most for Real Estate Intelligence Providers

1. Property Listings & Transactions

Property listings and transaction data are the foundation of any real estate intelligence model. Tracking pricing trends, rental yields, property features, availability, and historical fluctuations allows providers to build Automated Valuation Models (AVMs) and perform market benchmarking with precision.

For example, a valuation engine trained on five years of scraped rental yields across New York City delivered rent forecasts that were 15% more accurate than competitor models limited to MLS feeds. This shows how depth and breadth of listing data directly impact accuracy and competitiveness.

2. Land & Registry Data

Ownership records, permits, approvals, liens, and legal disputes form the compliance backbone of real estate intelligence. Providers rely on this data for risk assessments, title verification, and ensuring regulatory adherence.

Collecting relevant data helps uncover early red flags, such as hidden ownership disputes or pending litigation, that could derail investments.

3. Competitor Intelligence

Real estate is not just about properties, it’s also about market positioning. Monitoring competitor pricing strategies, new project launches, inventory levels, discounts, and promotional campaigns gives intelligence providers a competitive edge.

For instance, analyzing 5,000+ competitor listings weekly can uncover underpriced projects that investors could capitalize on, leading to higher yields. By integrating competitor intelligence into their models, providers can guide developers, agents, and investors with sharper market insights.

4. Market Sentiment Data

Beyond numbers, real estate decisions are deeply influenced by consumer psychology. Scraping social media conversations, property forums, and online reviews allows intelligence providers to capture real-time buyer sentiment. This layer of behavioral insight strengthens demand forecasting models.

For example, a surge of negative sentiment on housing forums can detect and offer early-warning signals that traditional data alone couldn’t provide. This shows why sentiment data is no longer optional in real estate forecasting.

5. Policy & Economic Indicators

Macro-level factors such as interest rates, tax changes, infrastructure announcements, and zoning laws often dictate property demand and pricing. Real estate intelligence providers increasingly scrape government portals and financial sources to integrate these shifts into their models.

For instance, when a European provider incorporated scraped tax change notices into its predictive models, it adjusted investment strategies ahead of competitors and avoided mispricing thousands of properties. Policy and economic data contextualize local trends and help providers deliver forward-looking insights.

Real-World Use Cases of Web Data Extraction

- Automated Valuation Models (AVMs): Daily scraped transaction data improves valuation accuracy by up to 20%.

- Market Benchmarking Dashboards: Real-time competitor tracking enables sharper market comparisons.

- Predictive Forecasting Models: Combining scraped historical + real-time feeds provides more accurate demand and pricing forecasts.

- Custom Data Feeds & APIs: Intelligence providers can monetize enriched datasets as premium offerings.

- Risk Intelligence Systems: Registry and government data highlight disputes or non-compliance early, reducing legal exposure.

The Strategic Benefits for Real Estate Intelligence Providers

- Real-time accuracy – Always serve clients with the latest market insights.

- Data at scale – Normalize millions of records across multiple sources.

- New monetization models – Sell enriched datasets or API subscriptions.

- Competitive differentiation – Deliver broader insights than rivals.

- Client trust & retention – Intelligence that is sharper and timelier increases adoption and renewals.

Global vs Local Data Needs

Real estate intelligence is not one-size-fits-all. Data requirements vary widely across regions due to differences in transparency, regulation, and availability. For instance, the US has open listing feeds, while many EU countries restrict registry access. Intelligence providers must adapt pipelines to handle both global scale and local granularity.

- United States: Multiple Listing Services (MLS) provide structured feeds, but competitive edge requires scraping supplementary portals.

- Europe: Stricter GDPR compliance and closed registries demand sophisticated, lawful scraping pipelines.

- Asia-Pacific: Emerging markets often lack centralized registries, making web scraping the only scalable option.

- Global Benchmarking: Providers need normalized pipelines to compare property markets across continents.

Beyond Residential: Commercial Real Estate Data Needs

While residential housing dominates headlines, commercial real estate (CRE) is equally data-hungry. Office spaces, warehouses, and retail centers require monitoring for vacancies, rental yields, and market dynamics. Intelligence providers must extend their scope beyond residential portals to include commercial transaction feeds, tenant demand signals, and corporate leasing activity.

- Office Leasing: Track rental rates, occupancy trends, and sublease activity.

- Retail Assets: Scrape mall footfall data, retail tenant churn, and pricing strategies.

- Warehousing & Logistics: Monitor industrial land demand and warehouse expansion data.

- Mixed-Use Projects: Capture hybrid residential-commercial trends impacting investment portfolios.

Compliance-First Data Strategies

With GDPR, CCPA, and global data privacy frameworks, compliance is no longer optional, it’s mission-critical. Real estate intelligence providers face reputational and legal risks if they mishandle scraped data. A compliance-first approach ensures datasets are ethically collected, anonymized, and aligned with both platform terms and jurisdiction-specific laws.

- GDPR Alignment: Build pipelines with automated anonymization and opt-out handling.

- CCPA Safeguards: Provide transparent data usage disclosures for California-based users.

- Registry Rules: Respect local restrictions on land and property ownership data.

- Audit Trails: Maintain detailed logs to prove lawful, ethical data sourcing.

Common Data Challenges in Real Estate Intelligence

- Messy Raw Data – Listings often have duplicate or missing fields; cleaning is essential.

- Dynamic Websites – Frequent HTML structure changes break basic scrapers.

- Compliance Risks – GDPR, CCPA, and registry terms require strict governance.

- Scalability – Internal teams often cannot handle surges in data volume.

Why Partner Instead of Building Alone?

Many intelligence providers attempt to build internal scraping setups, but they soon face ballooning infrastructure costs and ongoing maintenance struggles. By partnering with an expert like RDS Data, providers gain:

- Compliance Expertise – Built-in safeguards to avoid legal pitfalls.

- Dedicated Infrastructure – High uptime, fault-tolerant, and fast pipelines.

- Data Enrichment & Cleaning – Datasets are delivered ready for analysis, not raw.

- Adaptability – Scrapers evolve automatically with website changes.

- Cost Efficiency – Fraction of the cost of in-house teams and servers.

This allows intelligence providers to focus on their core, building smarter models and platforms while we manage the data backbone.

The Future: AI + Web Data Extraction for Next-Gen Intelligence

The convergence of AI/ML with high-quality scraped data is redefining the future of real estate intelligence:

- Hyper-local Forecasting – Predictive insights at street or block level.

- Dynamic AVMs – Daily updated valuations versus quarterly refreshes.

- Smart Investment Recommendations – AI-curated portfolios of undervalued or high-growth properties.

- Sentiment-Driven Predictions – Integrating consumer psychology into demand models.

- Sustainability Indicators – Scraped compliance data powering ESG-focused investments.

At RDS Data, we see data + AI not as a future add-on but as the foundation of next-generation platforms.

Conclusion: Building the Future of Real Estate Intelligence Together

Real estate intelligence platforms are tackling some of the industry’s toughest challenges, from pricing accuracy to compliance risk. But their success is tied to one factor: the quality, scale, and freshness of the data powering them.

By partnering with RDS Data, you gain:

- Comprehensive, real-time datasets spanning listings, registries, competitors, and sentiment.

- Compliance-focused pipelines designed for global regulations.

- Scalable, ready-to-use infrastructure that plugs directly into your intelligence models.

We don’t just deliver raw data, we provide the foundation of trust, innovation, and scale your clients demand. If you’re ready to transform your platform with richer, real-time data, let’s talk. Together, we can power the future of real estate

Tired of broken scrapers and messy data?

Let us handle the complexity while you focus on insights.